Case Study #3

Increased Monthly sales from $17,152.92 to $35,374.07!

Here’s how we doubled sales for a brand in skin care niche!

100% Increase in Revenue 50%+ Increased Profit

Here's how we transformed a brand's performance – growing their monthly revenue from $17,152.92 to $35,374.07!

“I`d love to pay for the value above but first I need to share a bad experience I have had previously with Amazon Ads management.”

“Previous company managing my amazon ppc was charging more per month and all the profit left from sales were spent on their fee.”

“that`s why I looked for an alternative and found You.”

“Therefore I`d like to propose a challenge, or an agreement.”

“If you are able to increase sales by 27% and keep the same ACOS range (avarege of 35%) we increase the fee to what you suggested.”

This is how one of our clients responded when we asked to start with a higher base fee. We accepted the challenge and started working for this brand starting in Dec – 2023. Here’s how we have progressed so far!

Marketplace: US

Category: Beauty & Personal Care

Products’ Price Range: $44.95 (single product with 3 variations)

Net Margin: 45%

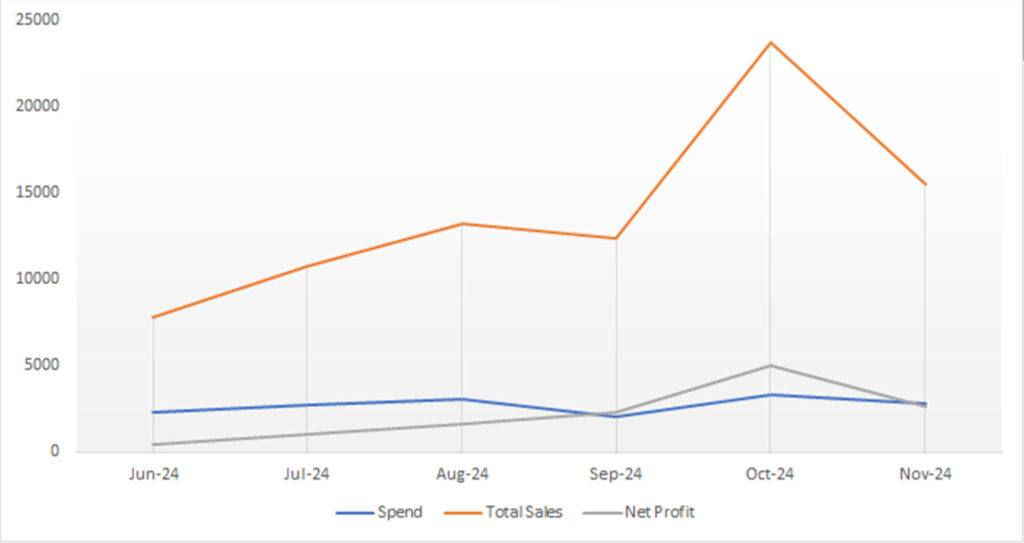

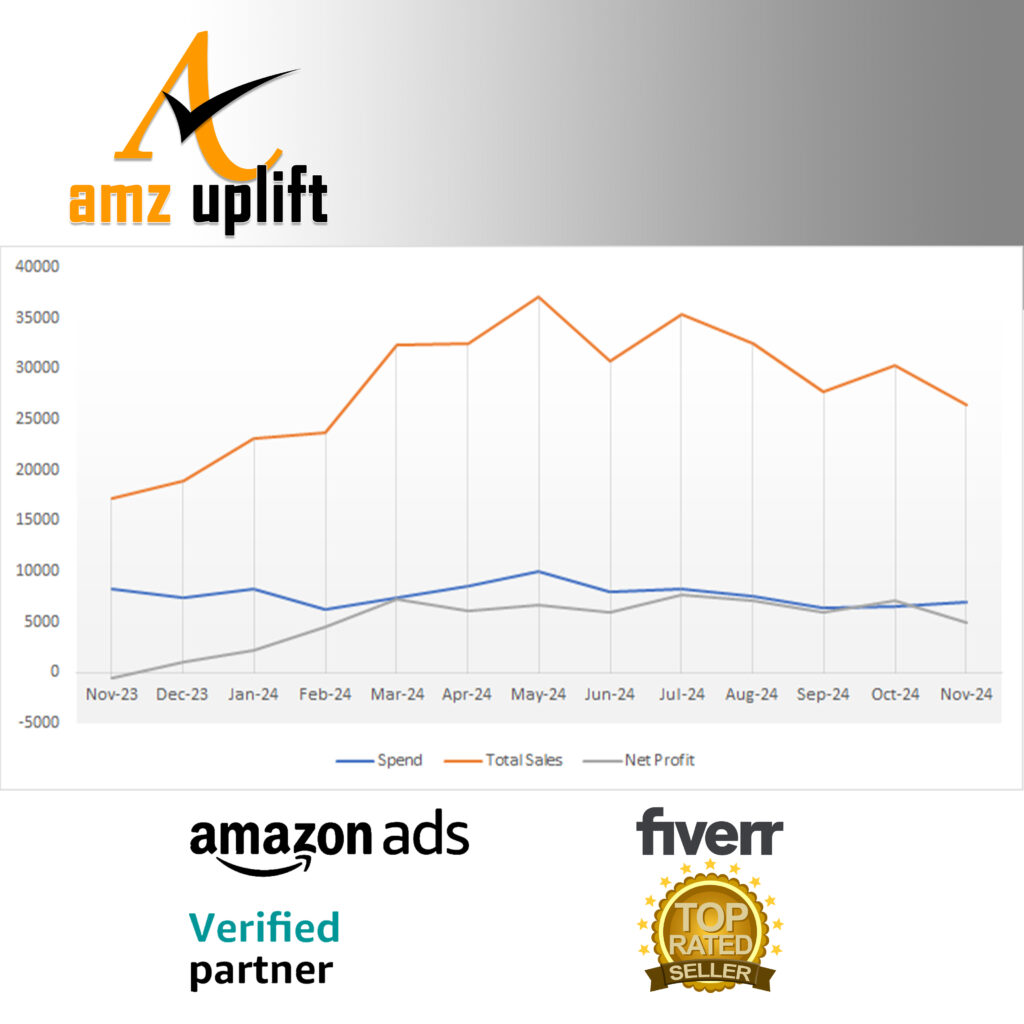

Nov 2023 (1 month before our joining):

Total Ad Spend: $8,308.29

Total Sales Generated: $17,152.92

TACOS: 48.43%

Net Profit: -$588.34

Dec 2023 (Our 1st month with this brand):

Total Ad Spend: $7,446.99

Total Sales Generated: $18,923.95

TACOS: 39.35%

Net Profit: +$1,069.20

Jan 2024:

Total Ad Spend: $8,202.61

Total Sales Generated: $23,194.20

TACOS: 35.36%

Net Profit: +$2,235.92

Feb 2024:

Total Ad Spend: $6,188.39

Total Sales Generated: $23,778.55

TACOS: 26.03%

Net Profit: +$4,510.79

March 2024:

Total Ad Spend: $7,327.90

Total Sales Generated: $32,364.00

TACOS: 22.64%

Net Profit: +$7,236.59

April 2024:

Total Ad Spend: $8,547.76

Total Sales Generated: $32,498.85

TACOS: 26.30%

Net Profit: +$6077.28

May 2024:

Total Ad Spend: $10,021.13

Total Sales Generated: $37,128.7

TACOS: 26.99%

Net Profit: +$6,686.87

June 2024:

Total Ad Spend: $7,974.05

Total Sales Generated: $30,835.7

TACOS: 25.86%

Net Profit: +$5,901.95

July 2024:

Total Ad Spend: $8,204.44

Total Sales Generated: $35,374.07

TACOS: 23.19%

Net Profit: +$7,715.08

Aug 2024:

Total Ad Spend: $7,593.6

Total Sales Generated: $32,584.25

TACOS: 23.30%

Net Profit: +$7,070.78

Sept 2024:

Total Ad Spend: $6,453.91

Total Sales Generated: $27,684.7

TACOS: 23.31%

Net Profit: +$6,004.81

Oct 2024:

Total Ad Spend: $6,580.2

Total Sales Generated: $30,287.48

TACOS: 21.73%

Net Profit: +$7,047.89

Nov 2024:

Total Ad Spend: $6,901.38

Total Sales Generated: $26,387.2

TACOS: 26.15%

Net Profit: +$4,973.98

We have had up & down numbers for this brand as seasonality was a major factor. However, if we look at YOY numbers, we managed to increase revenue as well as profitability. This brand sells maternity skincare cream and It’s a kind of niche that takes a dip in Sept-Dec phase and sales take a boost from Jan onwards.

Having achieved the highest sales as well as profitability numbers for this brand in May-Aug phase, we knew sales would remain low in Sept-Dec phase having got familiar with the product nature. Therefore, we made our efforts to keep profits stable by keeping monthly ad spend under control. As a result, we did experience a slowdown in sales in Sept-Nov phase but we maintain improved profits compared to the last year.

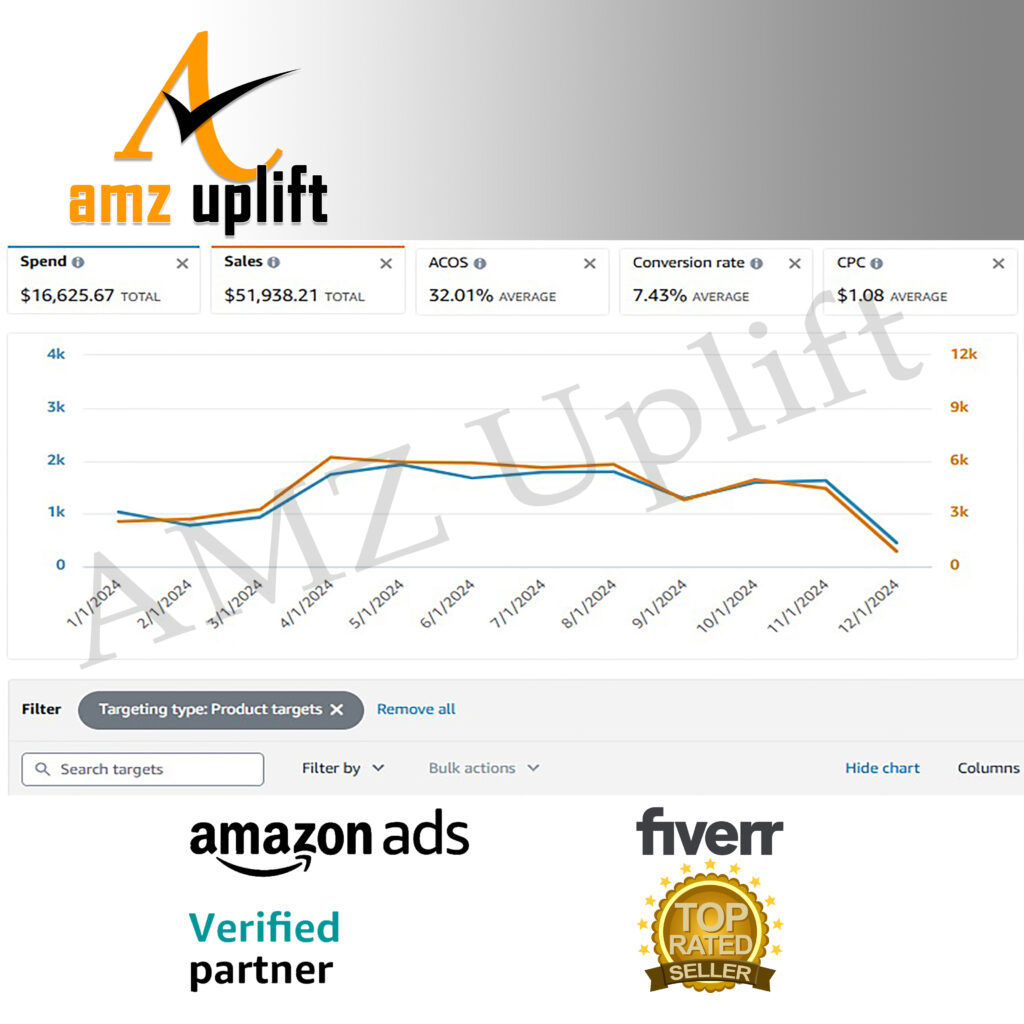

PPC Strategy to scale this brand:

Amazon advertising is surely expensive for Beauty & Personal Care category. Due to a number of established brands, we knew that TOS placement for top keywords would be a costlier option and hence going for ranking-oriented campaign structure may prove to be counterproductive.

We also checked the account history and found several campaign testing done previously. Most of the advertising budget before us was consumed by aggressive exact match type campaigns. Not much was tested with other match types or even low-cost conversion campaigns like sponsored brand or sponsored display ads.

We went ahead with broad targeting with low bids to catch more eyeballs. We also tested with video ads along with sponsored display product targeting. This structure worked out well for us and we managed to reduced advertising budget with increased sales resulting in a lower ACOS across most of our campaigns.

Campaign Types Used so far:

Sponsored Product broad match type has produced most sales for us at a decent ACOS. Apart from this, phrase match type and product targeting campaigns also helped us in maintaining our ACOS & consistent sales. We used Exact match type with limited keyword targets only as going aggressive with exact targeting would jeopardise our overall numbers. So far, exact is also doing pretty decent with limited set of search terms (converting only).

Apart from these, we also tested with video campaigns and worked on our brand store to improve our conversion rate. We tested multiple video assets and stuck with the best performing one. Having worked on our brand store, we utilized both SB video & banner ads to send direct traffic to our store pages and it went well for us.

One issue we did experience is a lower listing ratings score. With addition of new buyers due to our marketing push, we experienced a drop in ratings which did impact our conversion rate. Therefore, we are also working out with our client to work out this aspect as well for a sustainable brand growth!

Conclusion:

It’s so vital to stand out from the competition if you are entering in any competitive niche on Amazon. If you continue to sell what other are selling, you may end up getting unnoticed or may have to adjust your prices with the competition leaving no room for profitability.

The brand owners in this case are from Brazil and their product contains special ingredients that makes us stand out! With made in Brazil tag and mentioning special skincare ingredients, we are experiencing decent numbers with a higher product price and slightly lower ratings score compared to the competition!

The key takeaway from this journey is the importance of innovation and alignment with a brand’s unique strengths. By emphasizing the distinctiveness of the product and setting up campaign structures accordingly, we are able to position the brand for long-term success.

While challenges such as maintaining high ratings persist, this case reinforces that consistent monitoring, testing, and optimization are critical to overcoming hurdles and sustaining growth in a competitive marketplace. We’re committed to continuing this momentum and exploring further opportunities to scale while ensuring profitability and brand sustainability.